In the world of homeowner association (HOA) and condo association management, one of the most critical aspects of financial health is the reserve fund. HOA reserve funds are necessary to cover major repairs, replacements, and long-term improvements that affect community assets. Whether you're maintaining a condo building or resurfacing a community pool, a well-funded reserve is the key to keeping your community financially stable.

But how much should a condo association have in reserves? How much should an HOA set aside to be adequately prepared? This blog will explore HOA reserve requirements, common rules of thumb for condo reserves, and strategies for calculating the right amount. We will also address how events like recent hurricanes, Helene and Milton, have emphasized the need for communities to plan proactively.

Why Are HOA Reserves So Important?

HOA reserves act as a safety net for communities. These funds ensure that when major repairs or replacements are needed, they can be addressed without putting financial strain on residents. Without adequate reserve funds, communities risk imposing costly special assessments, which can lead to unrest among homeowners.

For example, after natural disasters such as hurricanes in Florida, a well-funded reserve becomes even more vital. While insurance may cover some of the damage, insurance alone shouldn't be relied upon for long-term repairs. Recent hurricanes like Helene and Milton remind us of the importance of being prepared for both routine and unexpected expenses.

How Much Should an HOA or Condo Have in Reserves?

Determining how much reserve an HOA should have in reserves is one of the most common questions asked by board members and residents alike. While the exact amount depends on the unique needs of your community, a general HOA reserves rule of thumb is to aim for 70-100% of the anticipated repair costs over the next 20 to 30 years. This helps communities avoid financial surprises.

For condo reserves, the rule of thumb remains similar. By setting aside 70-100% of the estimated costs for future capital projects, associations can cover repairs like roof replacements or repaving roads without requiring immediate out-of-pocket contributions from residents.

Having less than 70% in reserves is considered underfunded, which can lead to financial difficulties like needing to impose special assessments or increasing dues. A well-funded reserve helps protect against these issues and ensures the community can maintain its infrastructure and handle unexpected expenses. This percentage guideline is supported by industry standards such as the National Reserve Study Standards developed by the Community Associations Institute (CAI) Association Reserves.

This calculation isn’t just guesswork — it’s based on a reserve study that assesses the current state of your assets, predicts when they’ll need repair or replacement, and estimates the cost.

For example, take this particular community. As you can see from the graph, their numbers indicate an expected shortfall in 2031, meaning they will no longer be able to cover their projected reserve fund expenses. This leaves them with two options: either increase their reserve fund contributions from their annual budget or gradually raise dues over the next few years to meet the projected needs. Additionally, you can observe they are falling significantly behind the recommended 70-100% reserve funding level, which puts them at risk of financial strain in the future.

How Low Reserve Funds Can Affect Mortgage Eligibility and Home Values

Some lenders may not back a mortgage if the reserve fund is underfunded, which could ultimately keep home values below market rate. When potential buyers can't qualify for a mortgage, the demand for homes in the community decreases, making it harder to sell properties at full value, which impacts the overall financial health and desirability of the community.

Some people may not qualify for certain mortgages if a community’s reserve fund balance is too low. Many lenders, particularly those offering federally backed loans like those through Fannie Mae and Freddie Mac, require the HOA or condo association to have adequate reserves.

For example:

- Fannie Mae requires that condo associations allocate at least 10% of their annual budget toward reserves. If the reserve fund is underfunded, it may disqualify buyers from securing a mortgage for properties within that community.

- FHA-insured loans also have specific guidelines for the financial health of the HOA, including reserve funds. If the reserve fund is insufficient, buyers may be unable to qualify for an FHA-backed loan.

A low reserve fund balance can signal financial instability, which increases the risk for lenders. This could mean the property or community could be subject to higher special assessments or sudden increases in dues to cover repairs, which lenders want to avoid.

This is why maintaining a well-funded reserve is not only important for community upkeep but also essential for maintaining property values and ensuring that potential buyers can qualify for mortgages.

How to Calculate HOA and Condo Reserve Funds

If you're wondering how to calculate an HOA reserve fund, it typically involves assessing the current state of the community’s assets, estimating their lifespan, and calculating the future costs of repairs. The process of calculating how much your community should have in reserves starts with a professional reserve study. A professional study will include a detailed HOA or condo association reserve fund calculation, helping your board plan for long-term repairs and replacements.

The reserve study is a living document and should be updated regularly to reflect changes in inflation, the cost of materials, and any new assets or infrastructure that your community adds. A reserve study that’s five years old is unlikely to be accurate, so regular updates are essential to maintaining financial health.

Once the study is complete, the board will have a clear picture of how much should be set aside each year to meet future needs without imposing special assessments.

Additionally, many communities’ bylaws or CC&Rs provide specific guidelines on reserve fund requirements, such as the percentage of the budget that must be allocated to reserves and what the money can be spent on. These documents typically mandate coverage for high-cost items like roofs, roads, or community amenities, ensuring funds are available for repairs and replacements. Boards are legally obligated to adhere to these guidelines to prevent financial instability and potential legal issues.

The Impact of Natural Disasters on Reserve Studies

Natural disasters, such as hurricanes in Florida or wildfires in California, are a stark reminder of why having a strong reserve fund is essential. Condo reserves and HOA reserve funds are not only used for regular wear and tear but also for immediate responses to disasters. While insurance may cover a significant portion of damage costs, relying solely on insurance for long-term maintenance is risky. Hurricanes Helene and Milton recently hit Florida, Georgia, and North Carolina, causing widespread damage that went beyond what insurance could cover. For HOAs and condo associations, having a well-maintained reserve fund allows for quick responses to such disasters without the need to impose special assessments or delay crucial repairs.

Additionally, when infrastructure is properly maintained, it is often more resilient and better equipped to withstand the impact of natural disasters, reducing the risk of significant damage compared to older, neglected systems. This proactive approach not only preserves the community’s physical assets but also minimizes disruption and long-term costs.

Building a reserve fund that accounts for natural disasters ensures your community can recover swiftly and stay ahead of maintenance needs.

What Can HOA and Condo Reserve Funds Be Used For?

One common question from both board members and residents is, What can HOA reserve funds be used for? Reserve funds are typically set aside for major repairs, replacements, and capital improvements. Some common uses for reserve funds include:

- Replacing roofs

- Resurfacing pools

- Repaving roads and parking lots

- Replacing major equipment like HVAC systems

It’s important to understand that reserve funds cannot usually be used for routine maintenance or minor repairs — those expenses should come from the operating budget. Legal guidelines also dictate that reserve funds must only be used for expenses that align with the community’s long-term repair and replacement needs.

Reserve Fund Laws and Requirements

Understanding HOA reserve fund laws is crucial for board members to ensure compliance and avoid legal liabilities, especially in states where reserve studies are legally mandated. States like Florida and California, have specific laws governing HOA reserve requirements. For example, Florida's Statute 718 mandates regular HOA and condo reserve fund studies to ensure communities are financially prepared. Similarly, California requires an update to HOA and condo association reserve fund calculations every three years.

These laws are designed to protect homeowners and ensure that boards are planning for the long-term financial health of their communities. Ignoring these requirements can lead to legal penalties and increased liability for the board.

Using Technology to Monitor and Update Your Reserve Fund

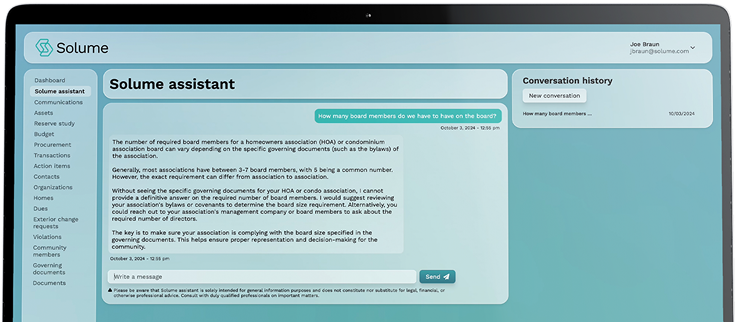

Technology has transformed the way communities manage their reserve funds. HOA reserve accounts no longer sit idle, waiting for an annual review. Instead, software like Solume turns reserve studies into dynamic, living documents. As work is completed — whether it’s replacing a roof or resurfacing a parking lot — Solume updates the financial projections in real-time. Regularly updating your reserve study helps ensure your community meets its hoa reserve fund requirements, which can vary based on state laws and the specific needs of your assets.

Solume integrates your homeowners association reserve fund with your overall financial management strategy, ensuring that your reserve study remains accurate and actionable. Solume’s AI-driven approach ensures that you have a clear picture of your condo association reserve fund calculation, so you can make informed decisions and keep your community financially healthy.

Not only can Solume help you keep your reserve study accurate, but it can also integrate your reserve plan with your overall financial management strategy. Whether you’re a small HOA or a large-scale condo association, Solume’s technology ensures you’re always prepared.

Final Thoughts: Securing the Financial Future of Your Community

Ensuring that your HOA or condo association is financially secure requires proactive planning and careful management of reserve funds. By regularly conducting and updating reserve studies, understanding the legal requirements, and leveraging modern technology like Solume, your community can avoid financial shocks and remain on a stable financial footing for years to come.

Interested in learning more about how Solume can help streamline your community’s financial management and reserve planning? Download our free EBook, “Avoid Special Assessments: A Complete Guide to Reserve Studies” for more insights and solutions.